You probably didn’t expect this from a pawnshop business. But under the Anti-Money Laundering Act (AMLA), or Republic Act No. 9160, pawnshops are now treated just like banks and casinos.

You are considered a “covered person,” and that means you have serious responsibilities.

If someone uses your pawnshop for money laundering, kahit hindi mo alam, pwede kang ma-imbestigahan, ma-penalize, o matanggalan ng lisensya.

And the worst part? You do not even have to be part of the crime to be in trouble.

Sounds unfair? Maybe. But there is a way to protect your business, stay compliant, and avoid all the hassle.

Let’s talk about it.

How Pawnshops in the Philippines Get Used for Money Laundering

You probably thought, “Pawnshop lang naman, maliit na negosyo.” But to criminals, pawnshops are the perfect place to clean dirty money.

You handle high-value items, fast transactions, and minimal checks. That makes you a target. And as mentioned earlier, you’re considered a “covered person” under AMLA, just like banks. If anything shady slips through, your license, reputation, and entire business are on the line.

Here’s how it happens:

1. Fake or Borrowed IDs

Some customers present IDs that look real but are fake or borrowed. If your staff skips verification, you could unknowingly help someone hide their identity.

2. Recycled or Layered Transactions

That same necklace? It gets pawned again and again under different names. This creates false records and helps criminals make dirty money look clean.

3. Inside Jobs

A trusted employee might “assist” a suki without proper checks. You may not know, but under AMLA, you’re still liable.

4. Ghost Customers

No one physically shows up. A courier drops off an ID, picks up cash, and leaves. Everything looks legit on paper, but the signer? Doesn’t exist.

5. No Suspicious Transaction Reports (STRs)

By law, you must report anything unusual. Missing just one STR is already a violation, which can mean penalties.

6. Incomplete Records

AMLA requires you to keep transaction records for five years. If the AMLC requests them and you come up short, you could face fines or worse.

The scary part? Kahit wala kang alam, puwede ka pa ring maparusahan.

So, protect your license. Know the signs. Don’t let your pawnshop become part of someone else’s crime.

What Pawnshops Must Do to Stay AMLA Compliant

If you still think that AMLA only applies to banks, it’s time to update that mindset. As a pawnshop owner, you are held to the same standard. There are very specific requirements you need to follow, and missing even one could put your license, business, and reputation on the line.

As clearly stated in Republic Act No. 9160, you are required to “establish and record the true identity of its clients based on official documents.”

So, what does that actually look like in practice?

1. Verify every customer

Hindi pwedeng “Mukha namang okay.” You are expected to check valid IDs, confirm the person’s identity, and keep a copy. If someone uses a fake or borrowed ID and your team misses it, that is on you.

2. Keep full records for five years

Every transaction, every ID, every pawn ticket. If the AMLC asks and you cannot produce them, that is already a violation. Even if you had no bad intent.

3. Report suspicious transactions

If something feels off or does not match the customer’s profile, you must file a Suspicious Transaction Report. No report means no excuse.

4. Assign a compliance officer

This cannot be a formality. You need someone officially in charge of making sure your shop follows AMLA rules. And yes, the AMLC checks this.

5. Train your staff

Everyone on your team should know what to watch out for and how to respond. One mistake can cost you your license.

AMLA compliance is about protecting your shop from risks you cannot afford to ignore. Most pawnshop owners only realize the importance of this when penalties hit. Now that you know, you can stay ready before anything goes wrong.

The Right Tools Make AMLA Compliance Easier (and Cheaper)

Let’s be real. When you hear “compliance tools” or “digital system,” you probably think, “Ay, dagdag gastos na naman ‘to.” But that’s not the case anymore.

There are now simple, low-cost tools designed exactly for small businesses like yours. They help you meet AMLA requirements without the stress, the guesswork, or the paperwork overload.

Here are five tech solutions that help make your life easier:

1. Real-Time ID Verification

No more relying on gut feel. With ID scanning tools, you can instantly match a valid ID with a customer selfie and confirm if it’s fake, tampered with, or borrowed. Everything is documented right away.

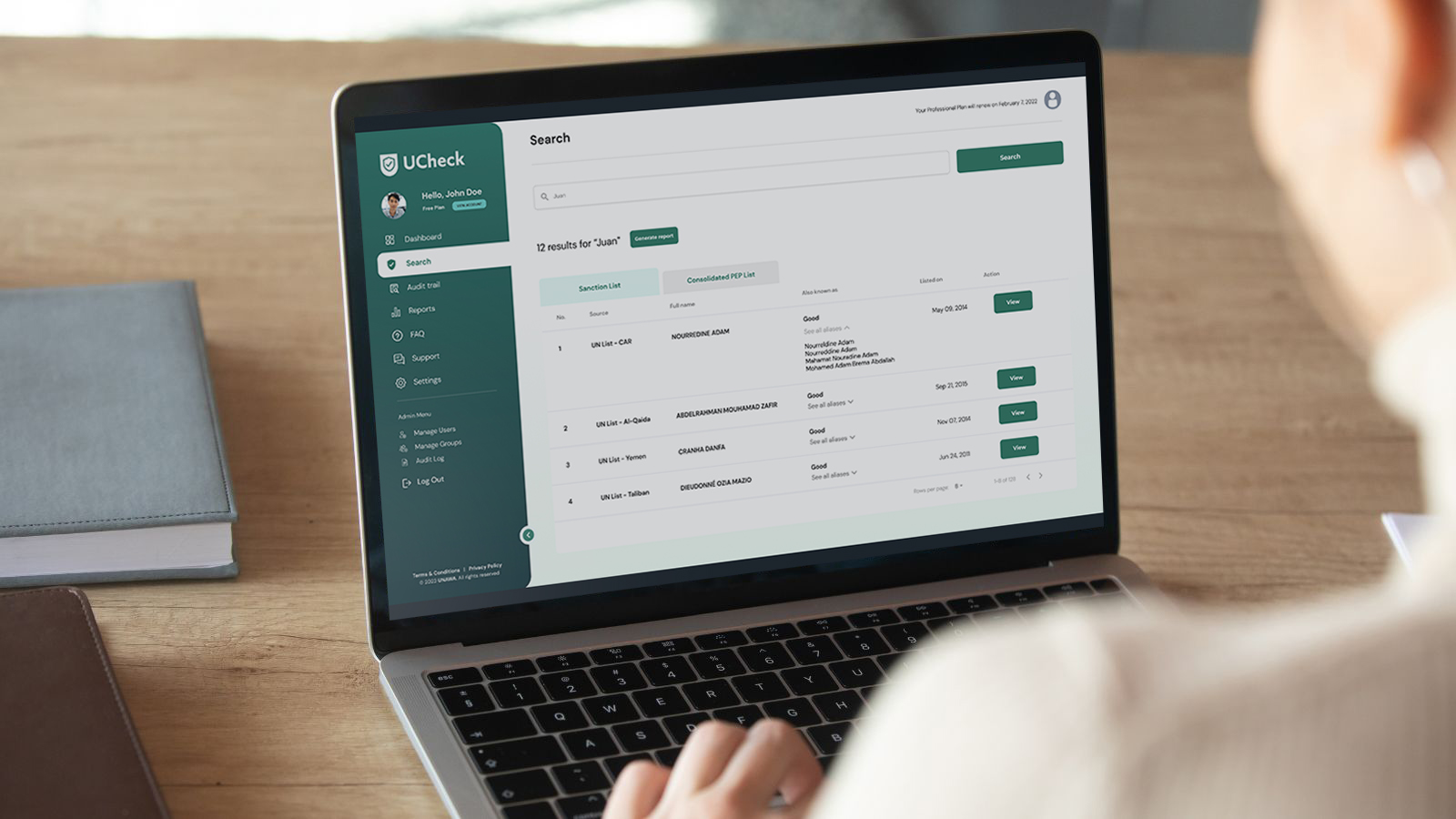

2. PEP and Watchlist Screening

Ever heard of a Politically Exposed Person (PEP)? Under AMLA, you’re expected to screen for them along with sanctioned individuals and other high-risk names. These tools check names against global watchlists automatically before you hand out a loan.

3. Smart Recordkeeping

Everything stays organized in one place. IDs, pawn tickets, dates, and STR submissions are saved digitally. When the AMLC requests your files, you don’t need to dig through drawers or folders. One click, and you’re ready.

4. Suspicious Transaction Detection

You may not always know what counts as suspicious. These systems analyze patterns and flag unusual transactions, like big amounts from a first-time client or quick repeat loans. It alerts you and suggests when to file an STR.

5. One Dashboard for Everything

You no longer need to memorize procedures or juggle notebooks. Your compliance officer can track everything from client profiles to reporting deadlines in one easy-to-use dashboard.

And no, you do not need fancy hardware or a tech team. Most of these tools are built for small businesses. Some are mobile-ready, subscription-based, and take less than an hour to set up.

They are no longer just for banks. They’re also designed for pawnshops, allowing you to remain compliant, protected, and open.

Protect Your Pawnshop Before It’s Too Late

If there’s one thing this article makes clear, it’s this: AMLA compliance is not optional. The risks are real. Even honest mistakes can cost you your business. But now that you know what to look out for and what is expected of you, you can take action.