Keeping detailed customer due diligence records isn’t just a best practice—it’s the law. Covered persons and institutions in the Philippines must maintain audit trails of their screenings, transactions, and risk assessments.

Manual logs (like ledgers, paper forms, or Excel sheets) come with significant operational risks and limitations—especially when the Anti-Money Laundering Council (AMLC) conducts an audit. Regulators expect more than just completeness. They expect traceability, integrity, and speed. That’s where digital audit trails like those in UCheck provide a clear advantage.

Manual methods often seem manageable at the start—until things scale or an audit looms. Here are the common challenges:

Even if the content of a manual log is complete, these issues raise red flags in an audit.

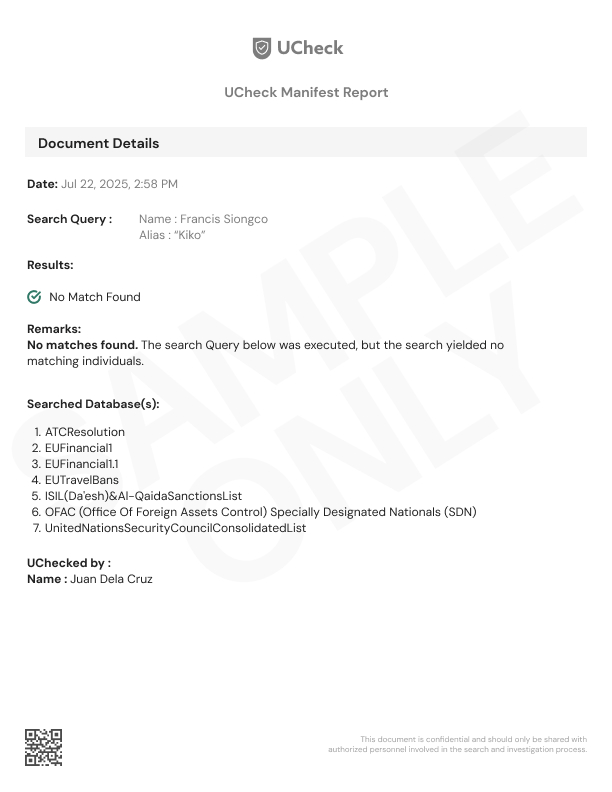

UCheck replaces these fragile, fragmented methods with automated, tamper-evident audit logs—designed specifically for AMLA compliance.

Here’s what you get with UCheck’s digital system:

As financial crimes grow more sophisticated, regulators are raising the bar for compliance. AMLC isn’t just checking if you registered your business and ran a few screenings—they’re checking how thoroughly you documented the process.

In an actual audit scenario, the burden of proof is on you. Can you show that your organization screened a specific client on a specific date? Can you verify who approved the screening? Can you prove the logs weren’t altered? With manual logs, these answers are slow and uncertain. With UCheck, they’re instant and indisputable.