Under the Anti-Money Laundering Act (AMLA), the Bangko Sentral ng Pilipinas (BSP) has reinforced the need for financial institutions—banks, pawnshops, remittance agents, financing companies, and others—to screen customers not just against watchlists, but also for “adverse media.”

That means: You’re now expected to monitor news reports and media mentions to detect if your customers are involved in criminal activity, corruption, fraud, or terrorism. Failing to do so could leave your business exposed to compliance gaps, audits, and even license revocation.

Adverse media refers to publicly available information—like news reports, blogs, or social media—that connects individuals or entities to suspicious or illegal behavior. BSP and AMLC regulators consider it part of enhanced due diligence, especially when dealing with higher-risk customers.

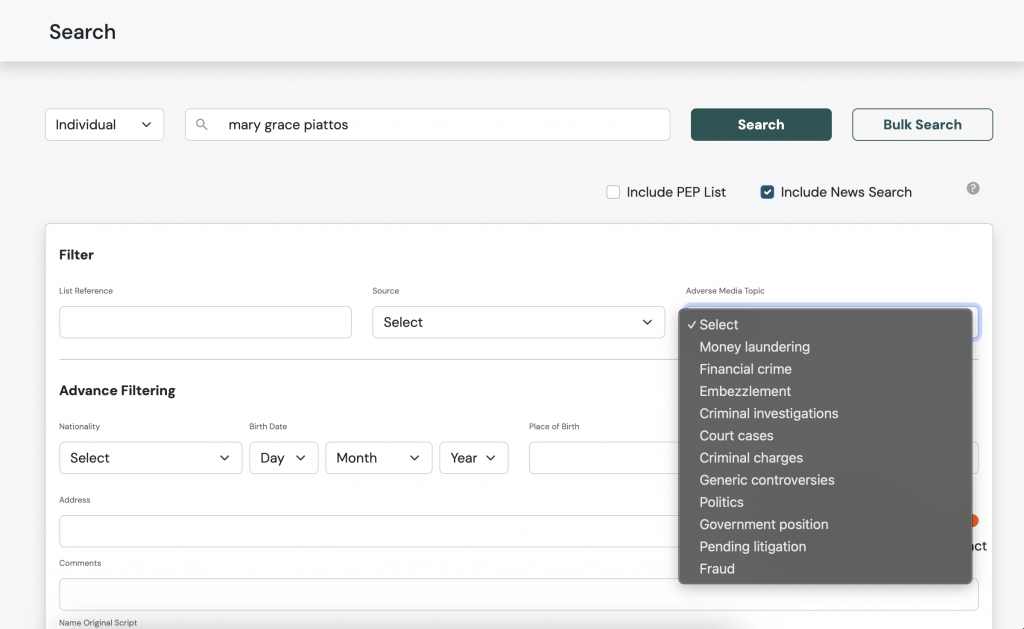

But simply Googling a name before onboarding a client isn’t enough. Manual methods often miss critical red flags—they can overlook reports from smaller or regional publications, aren’t performed consistently, and leave no traceable proof for audits. Most importantly, they offer no formal, tamper-evident log of the screening, putting your business at risk during regulatory inspections.

Let’s say you run a quick search for a customer’s name. You might miss news articles written in Filipino or regional languages, reports buried deep in search results past the first page, or updates published after onboarding but before your next compliance audit. These blind spots can leave your business exposed to risk—and without proper documentation, you won’t be able to prove due diligence when it matters most.

And when an AMLC officer asks you, “Did you screen this customer for adverse media on this date?”—you’ll have no formal proof. No log. No timestamp. No defense.

UCheck automates adverse media screening as part of your everyday CDD process.

So instead of relying on memory or scattered notes, you have searchable, legally-sound proof that your business is doing its due diligence.

The BSP has already begun revoking licenses of non-bank financial institutions that fail to comply with AMLA regulations. If your business isn’t proactively screening for adverse media, you could be the next in line.

It’s not just about checking a box—it’s about proving you’re doing it right, every time.