On paper, your new customer checks out. Clean background check, good credit, all documents in order.

Then the auditors arrive.

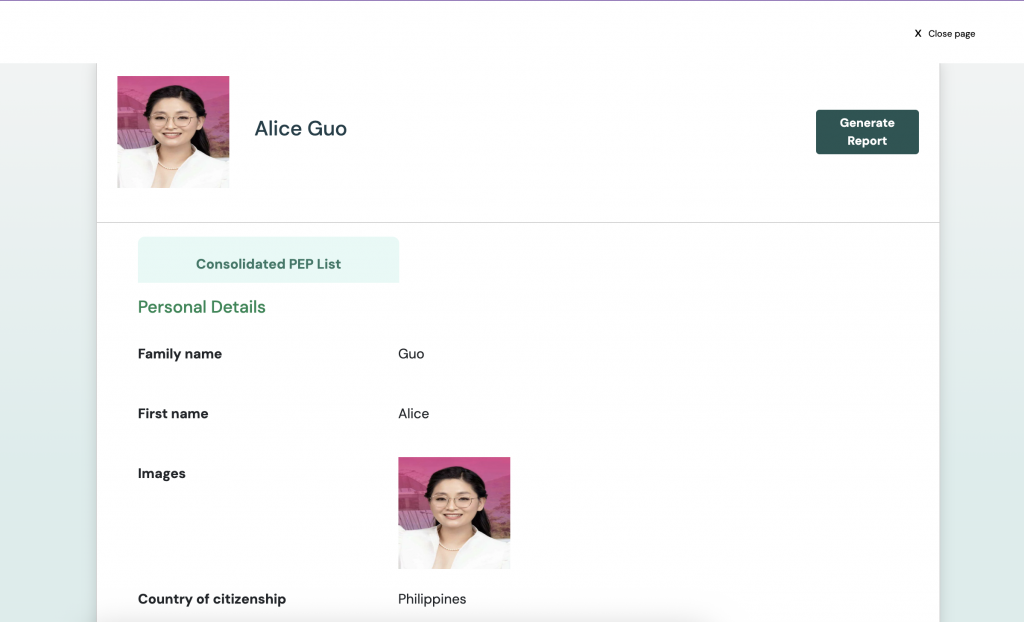

Turns out, your “ordinary” client is the cousin of a newly appointed government official—making them a politically exposed person (PEP) under AMLA rules.

That’s not just an awkward discovery. It’s a compliance red flag that could’ve been caught before onboarding.

The logic is simple: PEPs, by virtue of their influence and access to public resources, present a higher risk for corruption, bribery, and money laundering. Even if the PEP has no history of wrongdoing, financial institutions are required to treat them as higher risk and apply enhanced due diligence (EDD).

PEPs include individuals currently or formerly entrusted with prominent public functions, such as government officials, legislators, judges, military officers, and executives of state-owned enterprises. But the definition doesn’t stop there. Their close family members and associates—business partners, legal advisors, or even long-time friends—may also fall under PEP status.

Spotting a PEP isn’t always as simple as checking a “PEP list.” Many slip past manual screening because:

This is why relying on one-time, manual checks—especially Google searches—creates blind spots that only automated, multi-source PEP screening can close.

UCheck streamlines PEP screening by:

In compliance, proving you looked is just as important as looking. With UCheck, you can identify and document PEPs—before they become a problem.